- MBTI

- INTJ

Another socialist country fails and falls.

Huh.

Huh.

All the real capital or real value is still there, the failure is in the distribution of said capital, meaning it isn't as if they would need to be starving from lack of food available. There's something there... money > lives is the takeaway message. At least, that's where the world in general has its priorities at. Loan sharking is common, and obviously it's good for economies. Poofing money, in this case the illusion of value, into being out of thin air via things like high interest rates will inevitably result in things like this. It would have to be for short term ends that would have to be timely for long term goals for it to be worthwhile. Frivolous spending wouldn't count.

Ok given how economy's work... what in Greece do you see that has value? Im not saying that it doesnt but a country cant exist with its only product being food no matter how good it is.

This in part is what I am saying is wrong. The government has essentially been giving the people everything they need to survive with out requiring most to work for it. In that situation who WOULD get out of bed in the morning to go to any type of job?

Greece is an excellent example of exactly what can happen when government dependency 8s the norm.

Another socialist country fails and falls.

Huh.

I don't know, I'm not an expert in Greek's economy. I'm sure they have plenty, I don't care to do the research, because it's not going to change a thing. If you're not going to, you have no place saying that they don't have an economy that isn't fictitious and that it's a case of hopeless socialism.

They can call themselves what they like. The fact is that once you cross the threshold of complete government dependency you have a socialist system. A rose is still a rose under any other name.Fact check -

Actually they are a Parliamentary Republic, not socialist.

They can call themselves what they like. The fact is that once you cross the threshold of complete government dependency you have a socialist system. A rose is still a rose under any other name.

Okay okay...

Greece joined the EU and the Euro, the problem is the whole concept was bound to fail unless the richer countries are willing to even the playing field.

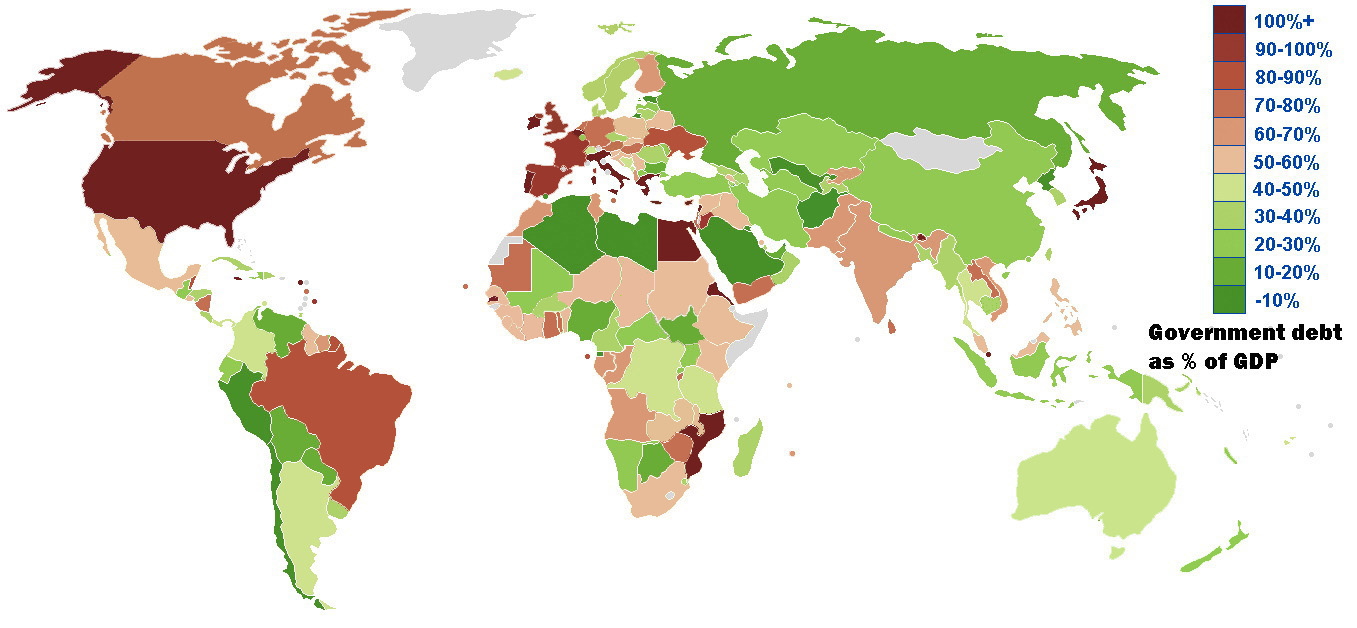

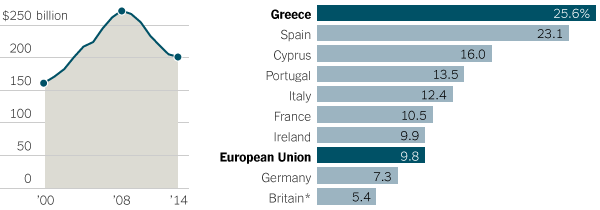

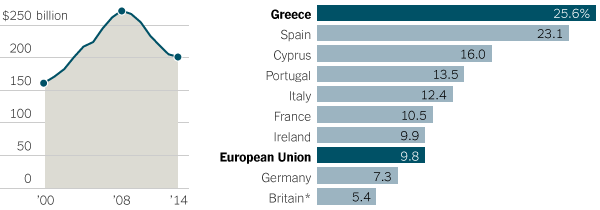

Greece has an unemployment rate of 25.6% currently, while richer countries like Germany (4.7%) are much lower.

This may not seem like the issue, but it ultimately is.

(This is the first quarter of the 2015 average)

So all these unequal counties are using the Euro…we do this ourself in the US as we have unequal distributions of how much money each state makes or needs in assistance…and so when poorer states like Mississippi and Kentucky are not doing as well as say - California, then money get shuffled around and we help those states that need more from those states that make more.

The problem with the Euro and Greece is no money was shifted to balance the poorer countries.

The US began this whole crisis in the first place…it was shortly after the collapse of Wall street that Greece announced it’s deficit problems.

So the IMF loaned them a shitload of money…with interest of course…this is how it differs from the US as states don’t pay back loans…money gets distributed.

Unfortunately, loans alone do not make for lower unemployment and higher GDP.

So when the IMF came knocking, Greece pushed heavy austerity cuts on it’s people…including making huge cuts to pensioners who could no longer work even if there was work.

And so we come to the recent vote….to tell the bank that they are crushing the people of Greece….it was basically a predatory loan.

Im not sure I would say the US caused it as much as it was major player. I mean we could lay blame on China and its way over inflated Renminbi value. Heres a country that just keeps printinting its own money with nothing to back it. Not to mention the thriving counterfeit creation and trade of the US dollar by them.

http://www.washingtonpost.com/opini...83ec7e-0095-11e5-833c-a2de05b6b2a4_story.html

Anyway in general as I said, Greece is just the first. I dont Know whats a better description. A house of cards or a jenga game in an earthquake.

Heres a country that just keeps printinting its own money with nothing to back it.

The US faces many of the same problems that is bringing Greece down. Our financial system is leveraged to the hilt, we have ever decreasing production, it is the norm to live beyond one's means, debt is still the name of the game, we are dependent on imports, the banks will need bailing again, but this time no one will be able to bail them, many millions are dependent upon federal aide of some kind etc etc. See any similarities? Socialism per se is not exactly Greece's problem of the moment.