InvisibleJim

Banned

- MBTI

- INTJ

- Enneagram

- 5w6

The Eurozone Bailout Plan

Problem

a) Governments are over indebted and cannot pay off their debts, particularly Greece, Spain, Italy and Portugal.

b) Governments are within euro and cannot deflate their currency to manage the debt.

c) An implosion within the euro has massive impacts on larger and more stable, non-indebted countries such as Germany.

The proposed solution

a) Use the funds held by the European Central Bank and Safety Fund (approx 500 Billion Dollars) as capital to raise approximately 4 Trillion Dollars

b) Send the money out left right and centre to 'forgive' approx. 50% of debt in countries like Greece.

c) Any excess may be used to protect weak banks which are heavily exposed to sovereign debt such as in France.

d) The 'mortgage' on the raised money is then paid collectively by the euro-zone governments thus transferring debt to Germany, etc.

Comment

a) Will Germany stand for it?

b) Does robbing Peter to pay Paul ever stop Paul living on the hair of the dog perpetually?

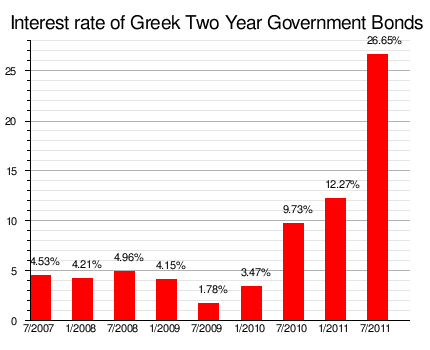

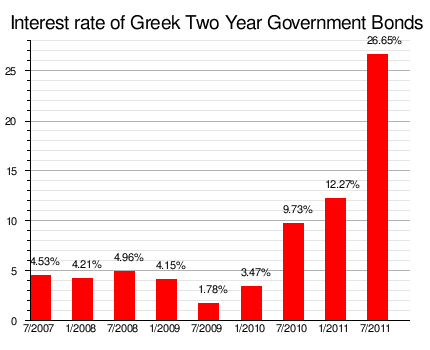

Le Chart.

Problem

a) Governments are over indebted and cannot pay off their debts, particularly Greece, Spain, Italy and Portugal.

b) Governments are within euro and cannot deflate their currency to manage the debt.

c) An implosion within the euro has massive impacts on larger and more stable, non-indebted countries such as Germany.

The proposed solution

a) Use the funds held by the European Central Bank and Safety Fund (approx 500 Billion Dollars) as capital to raise approximately 4 Trillion Dollars

b) Send the money out left right and centre to 'forgive' approx. 50% of debt in countries like Greece.

c) Any excess may be used to protect weak banks which are heavily exposed to sovereign debt such as in France.

d) The 'mortgage' on the raised money is then paid collectively by the euro-zone governments thus transferring debt to Germany, etc.

Comment

a) Will Germany stand for it?

b) Does robbing Peter to pay Paul ever stop Paul living on the hair of the dog perpetually?

Le Chart.