You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Working Until You Die

- Thread starter Faye

- Start date

More options

Who Replied?just me

Well-known member

- MBTI

- infj

The War on Poverty: 50 years of failure

This year marks the 50th anniversary of President Lyndon B. Johnson's launch of the War on Poverty. In January 1964, Johnson declared "unconditional war on poverty in America." Since then, the taxpayers have spent $22 trillion on Johnson's war. Adjusted for inflation, that's three times the cost...

just me

Well-known member

- MBTI

- infj

Corporations? Please explain.

copied from the above War On Poverty...

The culprit is, in part, the welfare system itself, which discourages work and penalizes marriage. When the War on Poverty began, 7 percent of American children were born outside marriage. Today the number is 41 percent. The collapse of marriage is the main cause of child poverty today.

Woe is me.

copied from the above War On Poverty...

The culprit is, in part, the welfare system itself, which discourages work and penalizes marriage. When the War on Poverty began, 7 percent of American children were born outside marriage. Today the number is 41 percent. The collapse of marriage is the main cause of child poverty today.

Woe is me.

Last edited:

- MBTI

- ENFP

- Enneagram

- 947 sx/sp

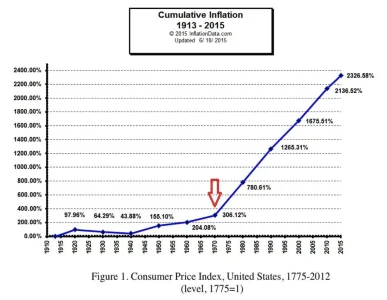

WTF Happened In 1971?

https://inflationdata.com/articles/2022/08/10/u-s-cumulative-inflation-since-1913/ "I don't believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can't take it violently out of the hands of government, all we can do is by some sly...

Roses In The Vineyard

Well-known member

- MBTI

- INFJ

just me

Well-known member

- MBTI

- infj

Search Assist

The learning curve for students often decreased during segregation due to unequal access to resources and educational opportunities, particularly for Black students in segregated schools. The 1971 Supreme Court decision in Swann v. Charlotte-Mecklenburg Board of Education allowed for busing to promote integration, aiming to improve educational equity and outcomes. Wikipedia

Wikipedia epi.org

epi.org

The ninth grade taught me more than high school. I was in school during those times.

Back to 1971, it was in August of that year that President Nixon severed the dollar’s link to gold.

What happened in 1971 is that the dollar’s value declined, only for the cost of creating wealth to soar. It’s very simple.

John Tamny, Forbes

Search Assist

In 1971, the official price of gold was approximately $40.62 per ounce, but it was allowed to float freely later that year, leading to market prices around $70 per ounce by the end of the year. This marked the beginning of a significant change in how gold was valued after the U.S. abandoned the gold standard. thealloymarket.com

thealloymarket.com Vaulted

Vaulted

The learning curve for students often decreased during segregation due to unequal access to resources and educational opportunities, particularly for Black students in segregated schools. The 1971 Supreme Court decision in Swann v. Charlotte-Mecklenburg Board of Education allowed for busing to promote integration, aiming to improve educational equity and outcomes.

The ninth grade taught me more than high school. I was in school during those times.

Back to 1971, it was in August of that year that President Nixon severed the dollar’s link to gold.

What happened in 1971 is that the dollar’s value declined, only for the cost of creating wealth to soar. It’s very simple.

John Tamny, Forbes

Search Assist

In 1971, the official price of gold was approximately $40.62 per ounce, but it was allowed to float freely later that year, leading to market prices around $70 per ounce by the end of the year. This marked the beginning of a significant change in how gold was valued after the U.S. abandoned the gold standard.

Last edited:

just me

Well-known member

- MBTI

- infj

WASHINGTON (AP) — The United States under the Biden and Trump administrations has provided at least $21.7 billion in military assistance to Israel since the start of the Gaza war two years ago, according to a new academic study published Tuesday, the second anniversary of the Oct. 7, 2023, Hamas attacks in Israel that provoked the conflict.

Last year, government spent $943 billion dollars providing cash, food, housing and medical care to poor and low-income Americans. (That figure doesn't include Social Security or Medicare.)

Last year, government spent $943 billion dollars providing cash, food, housing and medical care to poor and low-income Americans. (That figure doesn't include Social Security or Medicare.)

Roses In The Vineyard

Well-known member

- MBTI

- INFJ

Roses In The Vineyard

Well-known member

- MBTI

- INFJ

Roses In The Vineyard

Well-known member

- MBTI

- INFJ

Roses In The Vineyard

Well-known member

- MBTI

- INFJ

just me

Well-known member

- MBTI

- infj

The above quote was made in the year 2021, based on a 2020 quote regarding 2019 incomes.

www.snopes.com

www.snopes.com

Quotes from article:

According to the report, 9.3% of American households across all races made under $15,000; 8.1% of American households made $15,000 to $24,999; and 7.8% of Americans made $25,000 to $34,999. Added together, 25.2% of American households across all races made under $35,000 in 2021.

Also, according to that 2022 U.S. Census Bureau report, there was no racial group in which half the households made less than $35,000. stop

The report mentions how much families of five and families of six need to stay above the poverty level. No children?

Ask employees why they do little to nothing when their boss's back is turned away. We won't try to quote percentages, but I personally would have fired many people I see "working". Ask them why don't they work?

Do Half of Americans Make Less Than $35,000 a Year?

Complete government data on U.S. income for 2022 and 2023 was not available at the time of publication.

Quotes from article:

According to the report, 9.3% of American households across all races made under $15,000; 8.1% of American households made $15,000 to $24,999; and 7.8% of Americans made $25,000 to $34,999. Added together, 25.2% of American households across all races made under $35,000 in 2021.

Also, according to that 2022 U.S. Census Bureau report, there was no racial group in which half the households made less than $35,000. stop

The report mentions how much families of five and families of six need to stay above the poverty level. No children?

Ask employees why they do little to nothing when their boss's back is turned away. We won't try to quote percentages, but I personally would have fired many people I see "working". Ask them why don't they work?

- MBTI

- INFJ

- Enneagram

- 954 so/sx

$35,000 in 2020 is equivalent in purchasing power to about $43,812.40 today, an increase of $8,812.40 over 5 years.

The dollar had an average inflation rate of 4.59% per year between 2020 and today, producing a cumulative price increase of 25.18%.

If you remove the top 1% of earners, the average income in the U.S. drops significantly. This is why economists and organizations like the U.S. Census Bureau often prefer using the median income, which better reflects what a typical American earns. While it is difficult to calculate the exact figure, here are estimates based on analyses and reported data.

Estimate based on household data (2024 figures)

Based on 2024 data, the average household income for the bottom 99% is roughly $83,000 to $84,000.

Average income (all households): $121,000.

Median income: $83,730.

Income threshold for the top 1%: Over $416,000 in West Virginia to over $1,056,996 in Connecticut, with a national average of $731,492.

The fact that the median and the average for the bottom 99% are almost identical demonstrates that the high average for all households ($121,000) is almost entirely due to the extreme wealth of the top 1%.

Using 2024 data, the average personal income for the bottom 99% is approximately $45,000 to $46,000, based on the median personal income figures.

Average personal income (all earners): $67,080.

Median personal income: $45,140.

The effect of excluding the highest earners is most starkly illustrated by a simplified analysis of the top 1,000 earners. One social media analysis in May 2025, for example, highlighted a hypothetical where the average U.S. income drops from $74,500 to $35,500 simply by excluding the top 1,000 wealthiest earners. While simplified, it effectively shows how a small number of people can drastically skew the average.

The dollar had an average inflation rate of 4.59% per year between 2020 and today, producing a cumulative price increase of 25.18%.

If you remove the top 1% of earners, the average income in the U.S. drops significantly. This is why economists and organizations like the U.S. Census Bureau often prefer using the median income, which better reflects what a typical American earns. While it is difficult to calculate the exact figure, here are estimates based on analyses and reported data.

Estimate based on household data (2024 figures)

Based on 2024 data, the average household income for the bottom 99% is roughly $83,000 to $84,000.

Average income (all households): $121,000.

Median income: $83,730.

Income threshold for the top 1%: Over $416,000 in West Virginia to over $1,056,996 in Connecticut, with a national average of $731,492.

The fact that the median and the average for the bottom 99% are almost identical demonstrates that the high average for all households ($121,000) is almost entirely due to the extreme wealth of the top 1%.

Using 2024 data, the average personal income for the bottom 99% is approximately $45,000 to $46,000, based on the median personal income figures.

Average personal income (all earners): $67,080.

Median personal income: $45,140.

The effect of excluding the highest earners is most starkly illustrated by a simplified analysis of the top 1,000 earners. One social media analysis in May 2025, for example, highlighted a hypothetical where the average U.S. income drops from $74,500 to $35,500 simply by excluding the top 1,000 wealthiest earners. While simplified, it effectively shows how a small number of people can drastically skew the average.

just me

Well-known member

- MBTI

- infj

Then it would not be an average. My wife and I live off of less than poverty every year. Of course, we don't live in debt. We would love to get 35K a year.

Insurance(Obama Care and Affordable Healthcare) is difficult to pay. Car insurance, life insurance, home insurance, belongings insurance.....

Pay this amount, but your out of pocket added to the fees takes a large chunk of social security benefits. Medicine has out of pocket maxes that can be high. Food, gas, home healthcare(wow). Many small businesses cannot afford to pay high wages. When they try, they may go belly up. War devalues dollars, among many other things. Look at how many businesses have closed due to their losses to internet sales.

It may take two working parents to raise a family of four(not five or six), but look at how much they pay for childcare. Truck breaks down. Car goes to the shop. AC unit at home needs replacing, while maintenance gets higher and higher. Not everyone can afford to help pay people more money. Not everyone is worth what they are paid now. Look at how much a new roof costs nowadays.

Insurance(Obama Care and Affordable Healthcare) is difficult to pay. Car insurance, life insurance, home insurance, belongings insurance.....

Pay this amount, but your out of pocket added to the fees takes a large chunk of social security benefits. Medicine has out of pocket maxes that can be high. Food, gas, home healthcare(wow). Many small businesses cannot afford to pay high wages. When they try, they may go belly up. War devalues dollars, among many other things. Look at how many businesses have closed due to their losses to internet sales.

It may take two working parents to raise a family of four(not five or six), but look at how much they pay for childcare. Truck breaks down. Car goes to the shop. AC unit at home needs replacing, while maintenance gets higher and higher. Not everyone can afford to help pay people more money. Not everyone is worth what they are paid now. Look at how much a new roof costs nowadays.