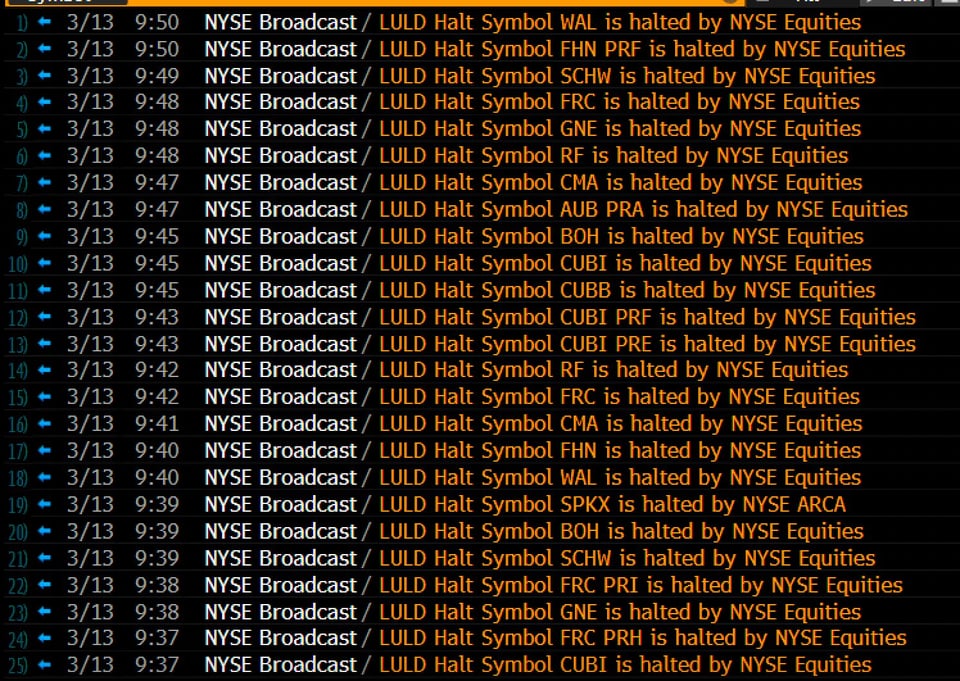

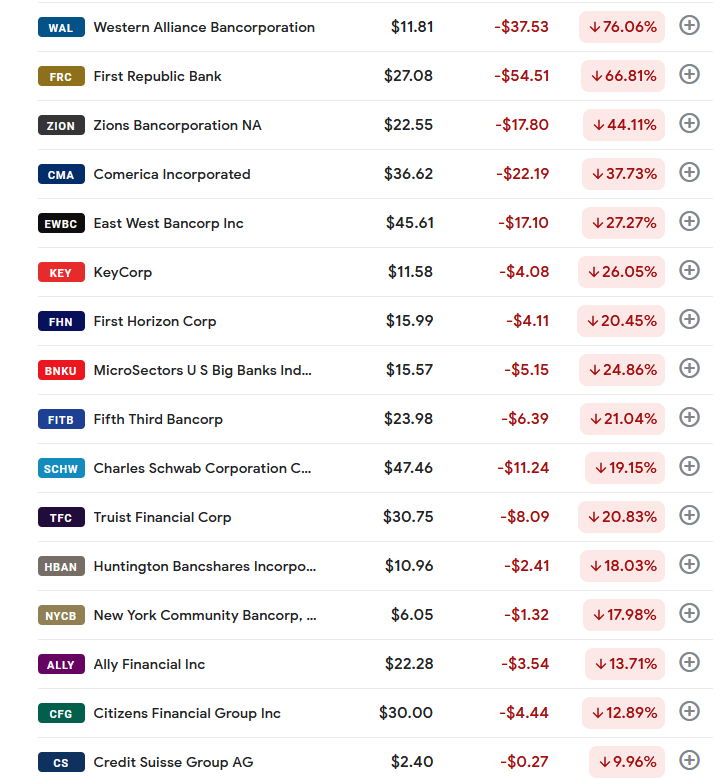

Not sure if anyone here has kept up lately but anyway there is some bad vibes with this. So in short two banks have failed only days apart with one being the second largest bank failure in US history. Should this be systemic and the crap starts hitting the fan it will be a wild ride for everyone with all the usual problems such as not getting paid on time or not being able to make withdrawals etc. At worst this could be a global problem before long.

One can keep track of any future failures here.

https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

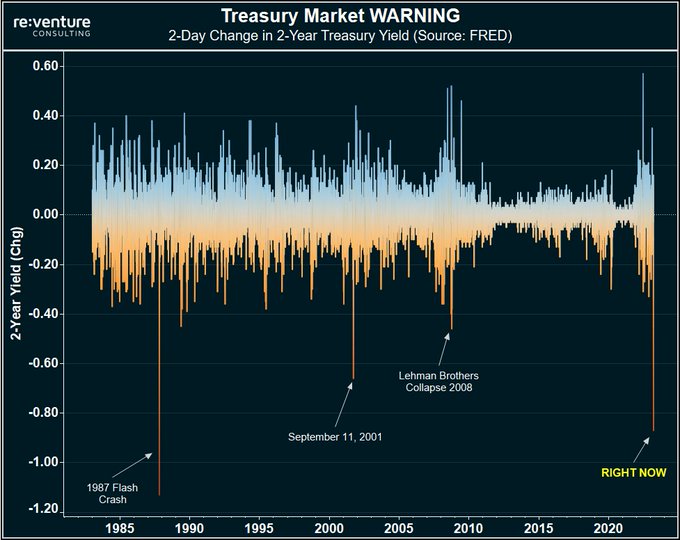

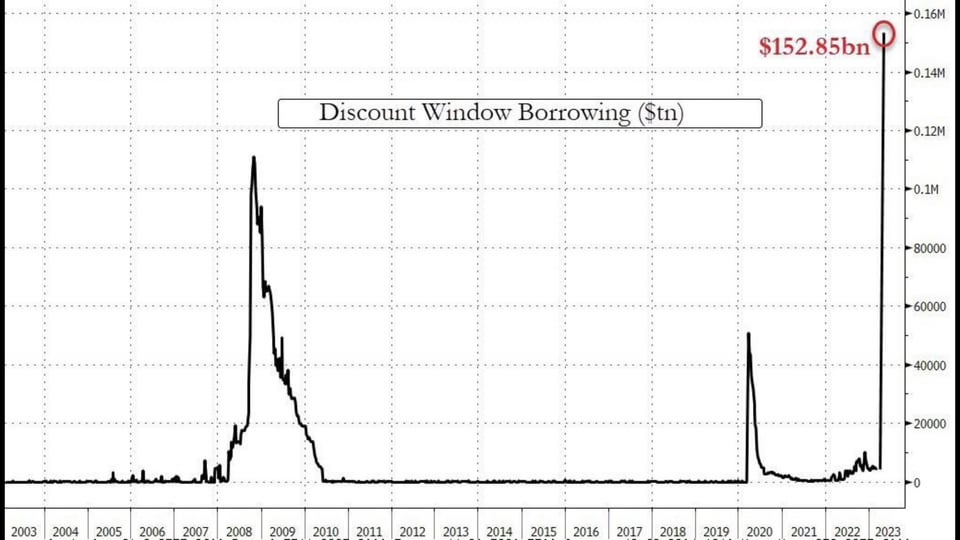

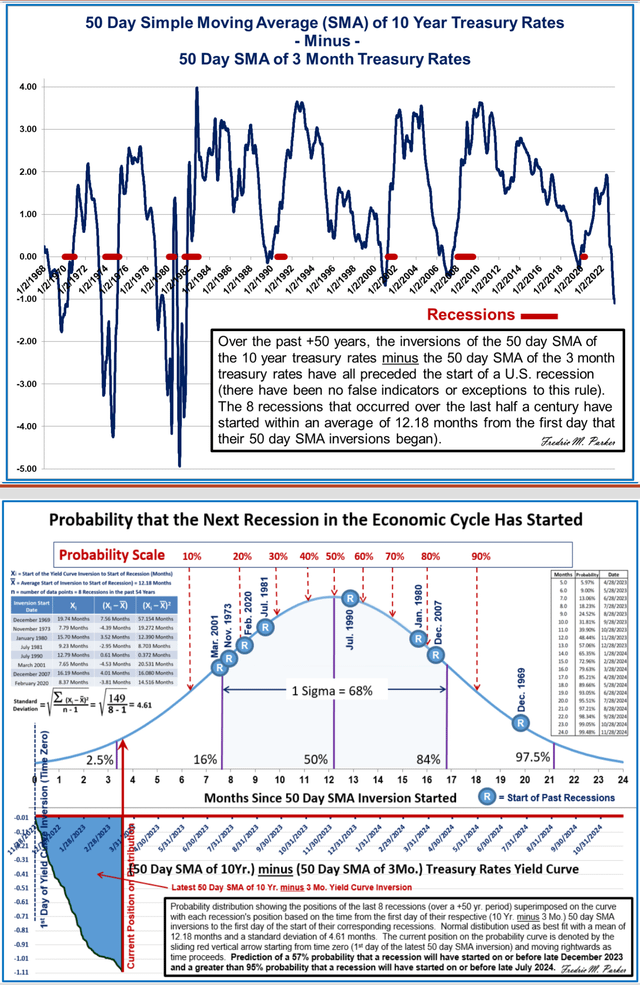

Some context

One can keep track of any future failures here.

https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

Some context