dragulagu

Galactic Explorer

- MBTI

- INTJ

- Enneagram

- 549

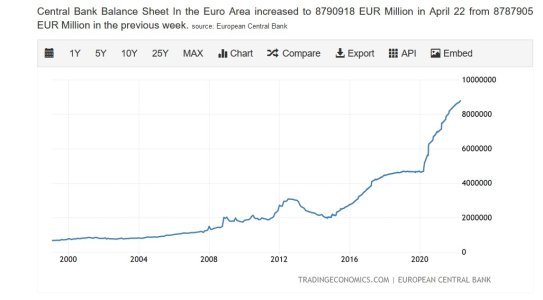

What the hell is happening..I'm confuzzled. Is Europe getting trapped in all what is happening now?

https://finance.yahoo.com/quote/EURUSD=X/

https://finance.yahoo.com/quote/EURUSD=X/

What the hell is happening..I'm confuzzled. Is Europe getting trapped in all what is happening now?

https://finance.yahoo.com/quote/EURUSD=X/

Just to clarify here @philostam instead of the one phrase response I did there. Europe won't be able to just print money without some strong political consensus ofThat is not how the European economy works. That is why I am responding like that.

Just to clarify here @philostam instead of the one phrase response I did there. Europe won't be able to just print money without some strong political consensus of

all its members. And in general the economical changes are both pushed through the IMF and the European central banking system. I don't think either will make

the decision to print out more euro's, like the central bank in the US does. But rather go with different funding strategies (it'll be a rough year though for the European economy).

https://www.euractiv.com/section/ec...eurozone-2022-growth-forecast-on-ukraine-war/

So do you drive a Lambo? LolAbundance of money leads to scarcity in society. Scarcity of money leads to abundance in society.

I suppose if you consider fiat money and money printing has its unethical aspects...

You’re lucky aeon to have parents who knew stuff. Mine were as ignorant as it comes, although they were nice people who had integrity and a certain natural wisdom. But they weren’t well educated or intellectual. But doesn’t money printing affect most people at the same time over the course of time? With probably exception of bankers and investors, which is always unethical imo

Yes I have done. As an INFJ in a Sensor family it took me a while but I got into books and now writing. Like all adversity, it taught me a lot.I didn't have such parents either, but so what? You can learn new things by yourself, you know?